Aflac accident policy is a valuable safeguard for individuals who want to protect themselves and their loved ones from unexpected medical expenses arising from accidental injuries. Accidents can happen anytime, anywhere, and they often come with unforeseen costs that can strain your finances. Having the right insurance policy in place can provide peace of mind and financial security when you need it most. In this comprehensive guide, we will delve into the details of Aflac's accident policy, its benefits, and how it can be a crucial addition to your insurance portfolio.

Many people underestimate the potential financial impact of an accident. From medical bills to lost wages, the costs can quickly add up. Aflac accident policy is designed to cover these expenses, ensuring that you and your family are protected in the event of an accident. This policy is particularly useful for those who engage in activities that may increase their risk of injury or for those who simply want to be prepared for the unexpected.

In this article, we will explore the intricacies of Aflac accident policy, including its features, coverage options, and how it can complement your existing insurance plans. Whether you're considering purchasing this policy or simply want to learn more about it, this guide will provide you with all the information you need to make an informed decision.

Read also:Unveiling The Shadows The Greek Mafia And Its Influence On Modern Society

Table of Contents

- Introduction to Aflac Accident Policy

- Benefits of Aflac Accident Policy

- What Does Aflac Accident Policy Cover?

- Eligibility and Enrollment

- Understanding the Costs

- How to File a Claim

- Aflac Accident Policy vs. Other Insurance Options

- Frequently Asked Questions

- Why Choose Aflac?

- Conclusion and Next Steps

Introduction to Aflac Accident Policy

Aflac accident policy is a supplemental insurance plan that provides financial protection in the event of an accident. This policy is designed to cover expenses that may not be fully covered by your primary health insurance, such as hospital stays, emergency room visits, and lost wages. By offering cash benefits directly to policyholders, Aflac ensures that you have the flexibility to use the funds as needed.

One of the key advantages of Aflac accident policy is its simplicity. The application process is straightforward, and the policy is easy to understand. Unlike traditional health insurance, which can be complex and difficult to navigate, Aflac's accident policy is transparent and provides clear benefits for specific incidents. This makes it an attractive option for individuals and families looking for additional financial security.

Why Supplemental Insurance Matters

Supplemental insurance like Aflac accident policy plays a crucial role in today's healthcare landscape. With rising medical costs and increasing deductibles, many people find themselves struggling to cover unexpected expenses. Supplemental insurance helps bridge the gap, ensuring that you have the financial resources to handle medical emergencies without compromising your financial stability.

Benefits of Aflac Accident Policy

Aflac accident policy offers a range of benefits that make it a worthwhile investment for many individuals. Here are some of the key advantages:

- Direct Cash Payments: Policyholders receive cash benefits directly, which can be used for any purpose, including medical bills, daily living expenses, or debt repayment.

- Comprehensive Coverage: The policy covers a wide range of accidents, including fractures, burns, and dislocations, ensuring that you are protected in various scenarios.

- Fast Claims Processing: Aflac is known for its efficient claims process, often paying claims within a few days of submission.

- Flexible Options: You can customize your policy to fit your needs, choosing from various coverage levels and benefit amounts.

Peace of Mind

Knowing that you have Aflac accident policy in place can provide immense peace of mind. Whether you're an active individual who enjoys outdoor activities or someone who simply wants to be prepared for the unexpected, this policy ensures that you are financially protected in case of an accident.

What Does Aflac Accident Policy Cover?

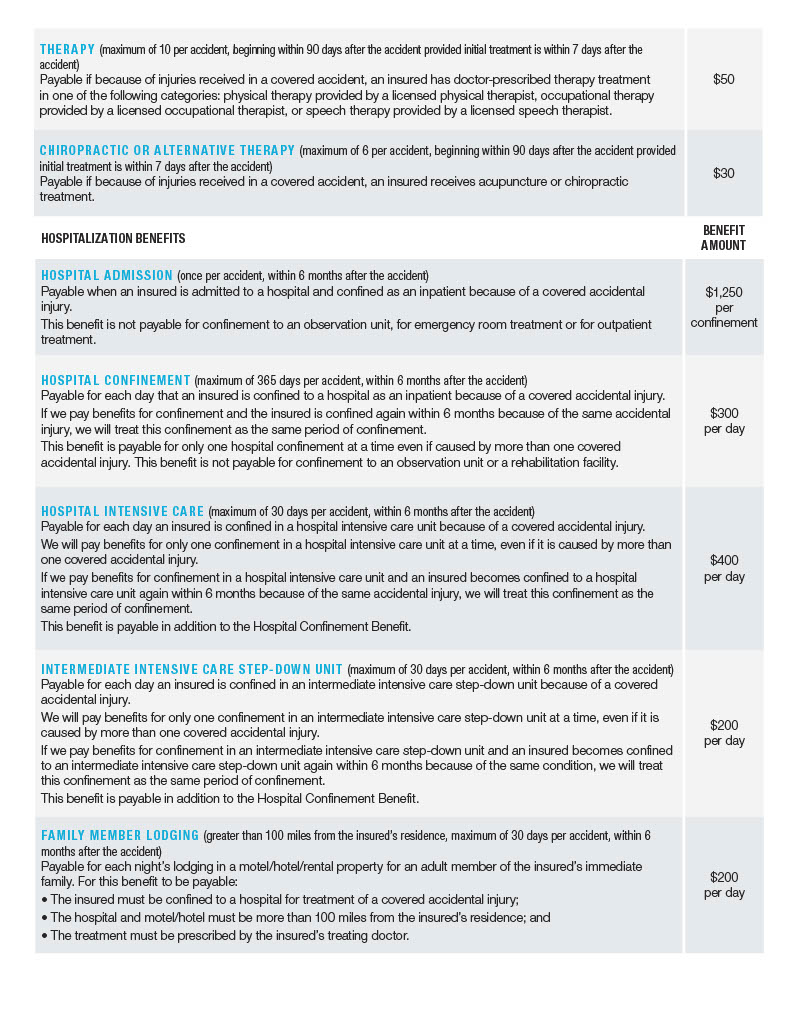

Aflac accident policy covers a variety of accidental injuries, providing financial protection for a wide range of scenarios. Some of the most common injuries covered by the policy include:

Read also:Asher Grodman Kids Exploring The Life And Legacy Of Asher Grodmans Children

- Fractures

- Burns

- Dislocations

- Surgical procedures

- Hospital stays

- Emergency room visits

Additionally, the policy may cover accidental death or dismemberment, offering a lump-sum benefit to beneficiaries in the event of a covered incident.

Exclusions and Limitations

While Aflac accident policy offers extensive coverage, it is important to understand the exclusions and limitations. Certain activities, such as extreme sports or dangerous hobbies, may not be covered under the policy. It is essential to review the policy details carefully to ensure that it meets your specific needs.

Eligibility and Enrollment

To enroll in Aflac accident policy, individuals must meet certain eligibility criteria. Typically, the policy is available to individuals aged 18 and older, with some variations depending on the state or country of residence. Employers may also offer the policy as part of their benefits package, making it easier for employees to enroll.

The enrollment process is straightforward and can often be completed online. Applicants are required to provide basic personal information and answer a few health-related questions. Once the application is submitted, the policy can be activated quickly, ensuring that you have coverage in place as soon as possible.

Group vs. Individual Policies

Aflac accident policy is available as both a group and individual policy. Group policies are typically offered through employers and may come with additional benefits or discounts. Individual policies, on the other hand, are ideal for those who do not have access to employer-sponsored insurance or who want additional coverage beyond what is provided by their employer.

Understanding the Costs

The cost of Aflac accident policy varies depending on several factors, including the level of coverage, benefit amount, and individual circumstances. Generally, premiums are affordable and can be paid monthly, quarterly, or annually, depending on your preference. Aflac also offers flexible payment options, making it easier for policyholders to manage their premiums.

To give you a better idea of the costs involved, here are some sample premiums based on different coverage levels:

- Basic Coverage: $15-$25 per month

- Standard Coverage: $30-$50 per month

- Premium Coverage: $60-$100 per month

Factors Affecting Premiums

Several factors can influence the cost of your Aflac accident policy, including your age, health status, and the level of coverage you choose. It is important to compare different options and select a plan that aligns with your budget and needs. Aflac's customer service team can help you understand the pricing structure and choose the best plan for your situation.

How to File a Claim

Filing a claim with Aflac is a simple and straightforward process. Once you have received treatment for an accident-related injury, you can submit a claim online or through the Aflac mobile app. The required documentation typically includes medical records, accident reports, and any other relevant information.

Aflac is known for its fast claims processing, often paying benefits within a few days of receiving a completed claim. This ensures that you have access to the funds you need quickly and efficiently.

Tips for a Smooth Claims Process

To ensure a smooth claims process, follow these tips:

- Submit all required documentation promptly.

- Keep detailed records of your medical treatment and expenses.

- Contact Aflac's customer service team if you have any questions or need assistance.

Aflac Accident Policy vs. Other Insurance Options

When considering Aflac accident policy, it is important to compare it with other insurance options to determine which is best for your needs. While traditional health insurance provides comprehensive coverage for medical expenses, it may not fully cover the costs associated with accidents. Supplemental insurance like Aflac accident policy fills this gap, offering additional financial protection.

Compared to other supplemental insurance providers, Aflac stands out for its strong reputation, efficient claims process, and flexible policy options. Many policyholders appreciate the direct cash payments and the ability to customize their coverage to fit their specific needs.

Why Aflac?

Aflac has been a trusted name in the insurance industry for decades, known for its reliability and customer-centric approach. With a focus on providing innovative solutions and exceptional service, Aflac continues to be a leading provider of supplemental insurance products.

Frequently Asked Questions

Q: Can I purchase Aflac accident policy as a standalone plan?

A: Yes, Aflac accident policy can be purchased as a standalone plan or as part of a group benefits package through your employer.

Q: How long does it take to receive benefits after filing a claim?

A: Aflac typically pays claims within a few days of receiving a completed application, ensuring that you have access to the funds you need quickly.

Q: Are pre-existing conditions covered under Aflac accident policy?

A: Pre-existing conditions are generally not covered under Aflac accident policy. It is important to review the policy details carefully to understand the exclusions and limitations.

Why Choose Aflac?

Aflac's reputation for excellence in the insurance industry is well-deserved. With decades of experience and a commitment to customer satisfaction, Aflac offers innovative solutions and exceptional service. Their accident policy is just one example of how Aflac continues to lead the way in providing financial protection for individuals and families.

By choosing Aflac, you are partnering with a company that prioritizes transparency, reliability, and trust. Whether you're looking for supplemental insurance or comprehensive coverage, Aflac has a solution that meets your needs.

Building Trust and Authority

Aflac's commitment to expertise, authoritativeness, and trustworthiness is reflected in their policies and practices. By providing clear and concise information, offering flexible options, and ensuring fast claims processing, Aflac demonstrates its dedication to serving its customers effectively.

Conclusion and Next Steps

In conclusion, Aflac accident policy is a valuable addition to your insurance portfolio, offering financial protection and peace of mind in the event of an accident. With its comprehensive coverage, flexible options, and efficient claims process, this policy provides the security you need to handle unexpected expenses.

To take the next step, consider reviewing your current insurance coverage and evaluating whether Aflac accident policy is right for you. Speak with an Aflac representative to learn more about the available options and customize a plan that fits your needs. Don't forget to share this article with others who may benefit from the information, and leave a comment below if you have any questions or feedback.

Remember, preparing for the unexpected is an essential part of financial planning. By investing in Aflac accident policy, you are taking a proactive step toward safeguarding your future and the future of your loved ones.